Learning Objectives

After completing this application-based continuing education activity, pharmacists and technicians will be able to

- Describe the benefits and features of the Medicare Prescription Payment Plan

- Outline the responsibilities of Part D Sponsors and dispensing pharmacies under the Medicare Prescription Payment Plan

- Discuss the characteristics of beneficiaries most likely to benefit from participating in the Medicare Prescription Payment Plan

- Explain the resources available for Medicare Beneficiaries to learn more about the Medicare Prescription Payment Plan

Release Date: July 25, 2024

Expiration Date: July 25, 2026

Course Fee

FREE

This CE was funded by Prime Therapeutics

ACPE UANs

Pharmacist: 0009-0000-24-033-H04-P

Pharmacy Technician: 0009-0000-24-033-H04-T

Session Codes

Pharmacist: 24YC33-XBK24

Pharmacy Technician: 24YC33-KXB69

Accreditation Hours

1.0 hours of CE

Accreditation Statements

| The University of Connecticut School of Pharmacy is accredited by the Accreditation Council for Pharmacy Education as a provider of continuing pharmacy education. Statements of credit for the online activity ACPE UAN 0009-0000-24-033-H04-P/T will be awarded when the post test and evaluation have been completed and passed with a 70% or better. Your CE credits will be uploaded to your CPE monitor profile within 2 weeks of completion of the program. |  |

Disclosure of Discussions of Off-label and Investigational Drug Use

The material presented here does not necessarily reflect the views of The University of Connecticut School of Pharmacy or its co-sponsor affiliates. These materials may discuss uses and dosages for therapeutic products, processes, procedures and inferred diagnoses that have not been approved by the United States Food and Drug Administration. A qualified health care professional should be consulted before using any therapeutic product discussed. All readers and continuing education participants should verify all information and data before treating patients or employing any therapies described in this continuing education activity.

Faculty

Lori R. Donnelly, RPh, PharmD

Consultant BluePeak Advisors,

Rolling Meadows, IL

Faculty Disclosure

In accordance with the Accreditation Council for Pharmacy Education (ACPE) Criteria for Quality and Interpretive Guidelines, The University of Connecticut School of Pharmacy requires that faculty disclose any relationship that the faculty may have with commercial entities whose products or services may be mentioned in the activity.

Lori Donnelly is an employee of BluePeak Advisors, a division of Arthur J. Gallagher & Co.

Any conflict of interest has been mitigated.

ABSTRACT

More than 1.4 million Americans paid drug costs of $2000 or more in 2020. Starting January 1, 2025, the M3P allows Medicare Part D members the option to pay for their Part D medications through a monthly invoice while paying nothing at the pharmacy counter. This change has operational and financial impacts for many areas of pharmacy. M3P claims processing requires coordination between Plans, PBMs, and dispensing pharmacies. Pharmacists and pharmacy technicians can help their patients benefit from the M3P by educating themselves and their patients about the program.

CONTENT

Content

INTRODUCTION & BACKGROUND

The Inflation Reduction Act (IRA) of 2022 is a large piece of legislation that included a wide range of provisions, including clean energy, tax revenues, and healthcare costs. The Medicare Part D changes contained in the IRA aim to make prescription drugs more affordable for Medicare beneficiaries.1

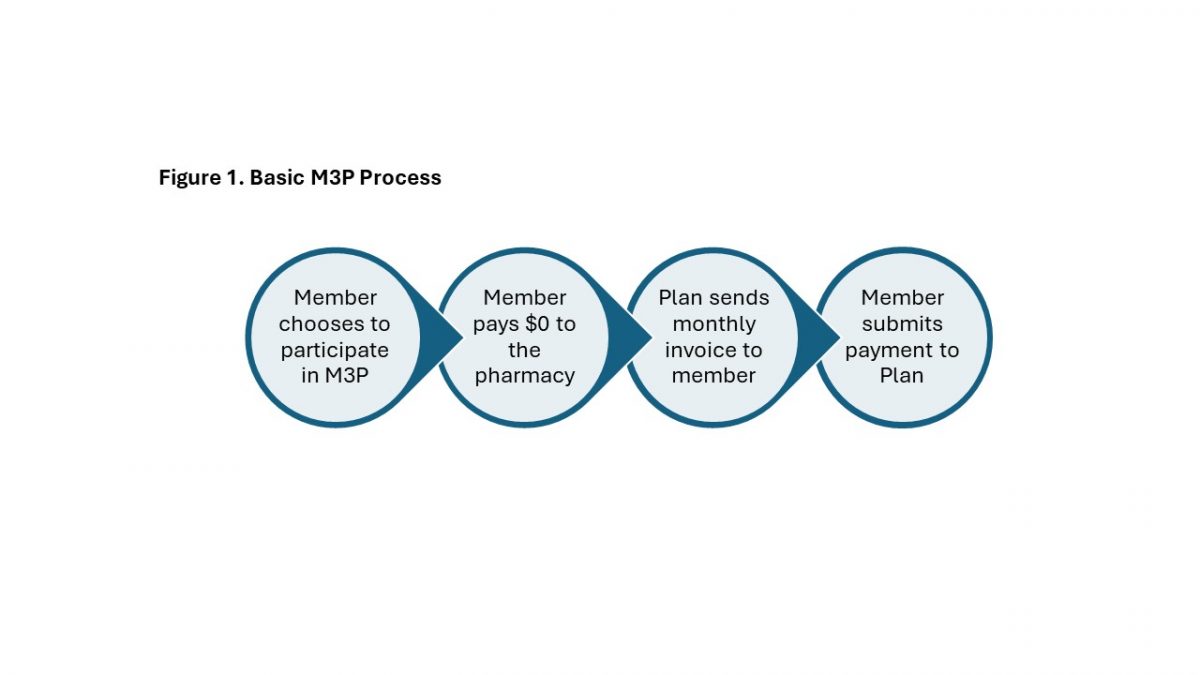

One of the Medicare Part D changes included in the IRA is the Medicare Prescription Payment Plan (M3P). Starting January 1, 2025, the M3P allows Medicare Part D members the option to pay for their Part D medications through a monthly invoice while paying nothing at the pharmacy counter.2 This change has operational and financial impacts for many areas of pharmacy, including dispensing pharmacies, Medicare Part D Plans (Plans), and Pharmacy Benefit Managers (PBMs).

Overview of the Medicare Prescription Payment Plan

The Kaiser Family Foundation estimated that more than 1.4 million Americans paid drug costs of $2000 or more in 2020.3 While the IRA contains other provisions designed to lower prescription drug costs, the M3P does not change the amount that patients pay for their medications. Instead, the M3P (originally called “copay smoothing”) helps Medicare beneficiaries afford their prescriptions by “smoothing” the costs over monthly invoices instead of paying the full amount to their pharmacy. The IRA requires Plans to make the M3P available to any member who has out-of-pocket costs for Part D medications, regardless of their income or out-of-pocket amount. The M3P also requires Plans to4

- Educate members about the availability of the M3P

- Notify dispensing pharmacies when members are likely to benefit from participating in the M3P

- Reflect $0 member payment for approved M3P claims

- Allow multiple methods for members to opt-in to the M3P

- Issue monthly M3P invoices to participating members

- Include all prescriptions covered under Medicare Part D in the M3P

- Pay the dispensing pharmacy for the member’s portion of the drug cost

Figure 1 illustrates the basic process for patients who choose to participate in M3P.

The Centers for Medicare & Medicaid Services (CMS) requires Plans to educate members about the availability of M3P through a variety of channels. Plans must include general M3P information on their websites, when issuing new member identification, and with annual plan document mailings. Plans and dispensing pharmacies must also provide M3P information to targeted members who are likely to benefit from participating in the program. CMS has determined that members with out-of-pocket costs of at least $2000 in the first three quarters of the year or $600 for a single prescription are the most likely to benefit from using the M3P.5

M3P claims processing starts January 1, 2025, and requires coordination between Plans, PBMs, and dispensing pharmacies. For members not participating in the M3P, Plans, through their PBMs, must indicate that the patient is likely to benefit from the M3P on approved Part D prescription claims with patient costs that are $600 or more. Receipt of this information from the claim requires the dispensing pharmacy to provide educational materials about the M3P to the patient. While CMS requires pharmacies to distribute M3P information to patients in response to claims messaging, CMS does not require them to provide additional counseling about the program. Pharmacists and pharmacy technicians may, however, choose to educate themselves and their patients about the M3P to provide an elevated patient experience.5

PAUSE AND PONDER: What quick talking points can you provide to your patients to help them understand the M3P?

Approved Part D claims for patients who have opted into the program will include instructions for the dispensing pharmacy to send a secondary M3P claim. The secondary M3P claim must use a different Bank Identification Number/Processor Control Number (which pharmacy staff usually refer to as BIN/PCN) combination than the corresponding primary Part D claim. The National Council for Prescription Drug Programs (NCPDP) creates and maintains the standardized format for prescription claims transmission. NCPDP is adding specific transmission codes for PBMs to transmit M3P information to dispensing pharmacies.4 Table 1 describes the types of M3P claims processing information that dispensing pharmacies should expect starting January 1, 2025. Pharmacists and technicians should consult their employer’s training materials for specific instructions on providing patients with information about the M3P, using NCPDP M3P transmission codes, and submitting secondary M3P claims.

Table 1. Anticipated M3P Claims Messaging Information

| Patient Status | Claim Type | Message Type |

| Not participating in M3P | Approved Part D Claims with ≥ $600 patient cost | The member is likely to benefit from participating in the M3P; the pharmacy should provide M3P educational information. |

| Not participating in M3P | Secondary M3P Claims (if sent accidentally) | The member is not participating in the M3P program; the pharmacy should collect the member’s cost share based on the Part D claim. |

| Participating in M3P | Approved Part D Claims | The member is participating in the M3P; the pharmacy should send a secondary M3P claim. |

| Participating in M3P | Secondary M3P Claims | The corresponding Part D claim is not found. Transmission may have failed or the Part D claim has been reversed; the pharmacy should reprocess the Part D claim and then re-send the secondary M3P claim. |

| Participating in M3P | Secondary M3P Claims | The drug is not covered by Part D and therefore not eligible for M3P; the pharmacy should collect the member’s cost share based on the Part D claim. |

Members can start signing up for the M3P as early as October 15, 2024, which is the beginning of open enrollment for 2025 Medicare Part D coverage. They can also sign up any time after their 2025 Part D coverage starts. CMS requires Plans to accept M3P participation requests by mail, telephone, or through a website application.4 CMS does not currently require dispensing pharmacies to process M3P election requests, and pharmacists and pharmacy technicians should direct patients to their Plan to sign up for the M3P.

Once a member opts into the program, their Plan will issue a monthly M3P invoice for all Part D prescription costs including the deductible and copay/coinsurance amounts. CMS requires Plans to issue M3P invoices separately from monthly premium invoices.4

Plans can remove members from M3P participation for failure to pay M3P invoices after a 2-month grace period but cannot disenroll members from Part D coverage for failure to pay M3P invoices. Members who are removed from M3P participation for falling behind on M3P payments can restore their M3P participation by paying their past-due M3P balance in full.4 Plans may disenroll members from Part D coverage for failure to pay monthly premium invoices after a 2-month grace period, even if their M3P invoices are paid in full.6 Pharmacists and pharmacy technicians can help M3P patients stay current with their payments by reminding them to pay both M3P and monthly Part D premium invoices. The SIDEBAR explains common terms.

SIDEBAR: Part D Patient Costs Defined

Monthly Premium: a monthly payment that maintains enrollment in the Plan; not impacted by deductible, copay, or coinsurance amounts

Annual Deductible: a yearly dollar amount the patient pays before their Plan starts to contribute to prescription costs

Copayment (or Copay): a specific, pre-determined dollar amount the patient pays for each prescription after satisfying the deductible

Coinsurance: an alternative to a copay, the percentage of the total cost the patient pays for each prescription after satisfying the deductible

Distribution of M3P responsibilities

CMS develops guidance and member-facing documents that Plans and PBMs use when building operational processes. For the M3P, CMS is providing Plans with5

- Detailed guidance documents that provide M3P requirements and invoice calculation instructions

- Content for plan mailings including the Annual Notice of Change, Evidence of Coverage, and Explanation of Benefits

- A fact sheet with educational language for Plan websites and printed materials

- An election request form

- Letters to notify members of M3P election, failure to pay, and termination from the program

- A targeted letter for members who are likely to benefit from participating in the M3P

CMS is also adding M3P information to the resources and educational materials that they provide directly to Medicare beneficiaries, including the annual Medicare & You Handbook, Medicare.gov, and Medicare Plan Finder.5

CMS assigns most of the responsibility for the M3P to Plans and holds Plans accountable for meeting all program requirements. Plans are responsible for delivering all aspects of the M3P but must rely on PBMs, vendors, and dispensing pharmacies for certain requirements. Table 2 provides an overview of the main activities that Plans must implement for M3P.4,5

Table 2. Plan M3P Responsibilities4, 5

| Activity | Requirements |

| Member education | · General information during open enrollment, with annual plan mailings, and on their website

· Targeted information prior to and during the plan year for members who are likely to benefit from the M3P |

| M3P participation processing | · Mail, telephone, and web-based options

· Accept M3P elections during open enrollment, before the start of the plan year · Activate completed M3P elections received during the plan year within 24 hours · Outreach to gather missing information from incomplete M3P election requests · Communication to PBM for claims processing |

| M3P claims processing | · Coordination and oversight of their PBM for

o Claims notification to pharmacies for members who are likely to benefit from M3P o Processing information and $0 copay/coinsurance for M3P participants o Payment to the dispensing pharmacy for the member’s portion of the drug cost |

| M3P Invoices and Payment Collections | · Monthly invoices based on CMS-required calculations

· 60-day grace period, then removal from M3P for failure to pay |

| Other | · Customer service

· Pharmacy and provider education · Data and reporting · Oversight of dispensing pharmacies |

While Plans hold the most responsibility for M3P, dispensing pharmacies play a large part in the program’s success. CMS requires all pharmacies who accept Part D prescription drug coverage to participate in the M3P. Pharmacists and pharmacy technicians must act on M3P claim information to distribute M3P materials to members and process M3P claims. Pharmacies may need to adjust their claim reversals and reprocessing procedures to ensure that both the primary Part D and the secondary M3P claims are included. For example, if a patient decides to fill a prescription for less than the original quantity, the pharmacy would need to first reverse both the Part D and M3P claims and then resubmit both claims with the new quantity. CMS also requires pharmacies to re-process claims for members who sign up for M3P after filling but before picking up their prescriptions.4,5

To benefit from the M3P, Medicare beneficiaries are responsible for reviewing the educational materials provided by CMS, their Plan, and their pharmacy. They also have the opportunity to use the tools provided by their Plan to determine if they would benefit from participating in the M3P. After signing up, members are obligated to pay their M3P invoices on a monthly basis to avoid being removed from the program. Members who sign up for the M3P may decide later to drop out of the program but are still responsible for paying invoices incurred during their M3P participation. 4,5

Monthly invoice calculations and members most likely to benefit from participating in the M3P

The monthly invoice calculations required by CMS are complex and typically do not result in equal monthly installments. Members can sign up for the M3P at any time during the year, and the monthly invoice calculation for their first month in the program is different from the invoice calculations for later months. Invoice amounts also vary based on when the member signs up for the M3P and prescriptions purchased at the pharmacy before they entered the program. CMS protects members who participate in the M3P by prohibiting Plans from adding service/late fees or charging interest on M3P balances.4

PAUSE AND PONDER: What can you tell a patient who asks how the M3P is different than using a credit card to pay for his prescriptions?

CMS holds Plans responsible for accurately calculating M3P invoice amounts and answering member questions. Dispensing pharmacies are not required to explain invoice details but may benefit from understanding why not all patients will benefit from participating in the M3P.4

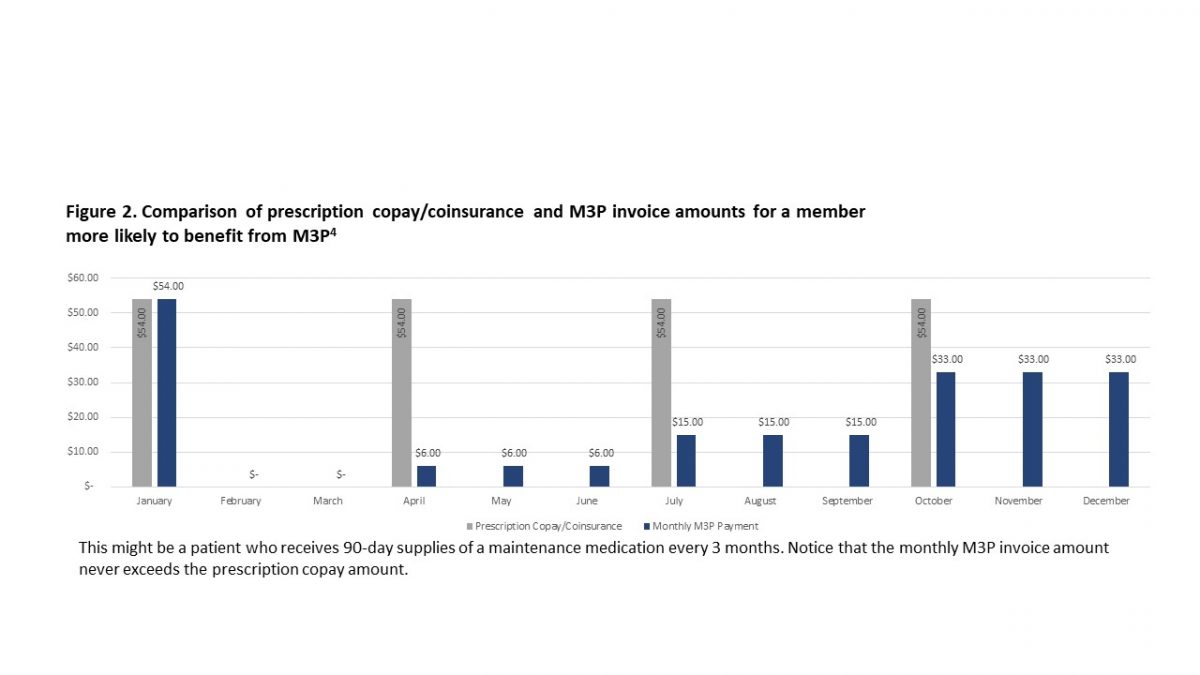

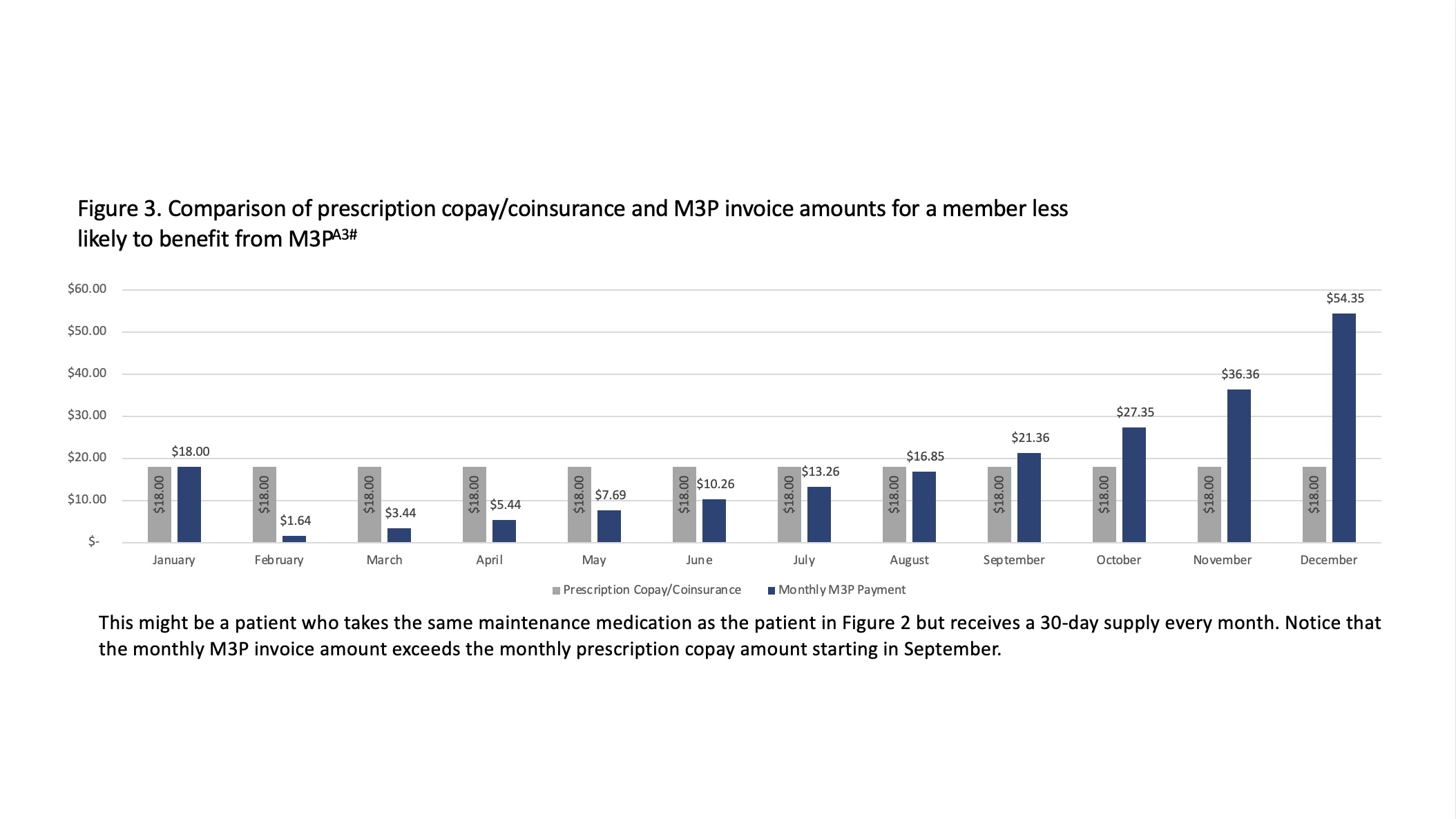

Figures 2 and 3 provide examples of pharmacy copay/coinsurance amounts compared to M3P invoice amounts for members who sign up for M3P in January. Both example members have the same out-of-pocket prescription costs for the year. The member in Figure 2 is more likely to benefit financially from the M3P because the monthly M3P invoice amount is never higher than what they would have paid at the pharmacy counter. In general, the higher the member’s out-of-pocket prescription costs the earlier in the year, the more likely the member will benefit financially from using the M3P.4

All Part D members are entitled to sign up for the M3P, regardless of their drug costs or M3P invoice amounts. Members who do not benefit financially from the M3P, such as the member illustrated in Figure 3, may have personal reasons for signing up for the program. For example, patients who rely on caretakers to pick up their prescriptions from the pharmacy may prefer the convenience of having no cost at the pharmacy counter. Patients may also pay more than their MP3 invoice amounts earlier in the year to reduce invoice amounts later in the year as long as they do not pay more than their total year-to-date copay/coinsurance amounts.4

Alternatively, patients may have non-financial reasons for not signing up for the M3P. They may not want to receive another monthly bill or may feel that paying for their prescriptions at the pharmacy provides better visibility into their drug costs. Even patients who would benefit financially from using the M3P may be put off by the uneven monthly M3P payment amounts. Patients who sign up for the M3P have the option to leave at any time if they feel they are not benefiting from the program.

PAUSE AND PONDER: What other non-financial situations may members face where they could benefit from the M3P?

M3P Resources

CMS has a number of resources available for anyone looking for more information about the M3P. They provide access to detailed M3P guidance, technical, and related information at https://www.cms.gov/inflation-reduction-act-and-medicare/part-d-improvements/medicare-prescription-payment-plan

CMS also provides an annual handbook entitled “Medicare and You” designed to educate members about all aspects of Medicare. When the 2025 version of “Medicare and You” is released by CMS in late 2024, it will include educational information about the M3P.5 The “Medicare and You” handbook is available at https://www.medicare.gov/medicare-and-you.

At the time of this publication, CMS is still developing additional resources, but expects information about the M3P to be available at www.medicare.gov.5

CMS requires Plans to provide information about the M3P on their websites before October 15, 2024. While the general M3P information included on Plan websites will likely be similar to the information provided by CMS, it will also include Plan-specific instructions and contact information.5

SUMMARY AND CONCLUSION

The M3P provides flexibility for Medicare beneficiaries who prefer to receive a monthly invoice instead of paying for their prescriptions at the pharmacy counter. The program requires complex operational changes for Plans, PBMs, and dispensing pharmacies.

CMS holds Plans responsible for the overall administration of the M3P, but PBMs and dispensing pharmacies have important responsibilities. Pharmacists and pharmacy technicians can help their patients benefit from the M3P by educating themselves and their patients about the program.

Good:

- Be familiar with your pharmacy’s procedures for processing M3P claims

- Provide M3P information to patients when prompted by your pharmacy’s dispensing system

- Refer patients to their Plan for additional information about the M3P

Better:

- Discuss the overall benefits of the M3P

- Answer patient questions about how the M3P works

- Describe the characteristics of patients most likely to benefit from using the M3P

Best:

- BE COMMUNITY CHAMPIONS! Stay abreast of upcoming changes and take the time to comment on proposed revisions to Medicare

- Assist patients with decisions about M3P participation

- Consider appointing one staff member to be your “M3P Expert” who deals with complex patient questions

Pharmacist & Pharmacy Technician Post Test (for viewing only)

Demystifying the Medicare Prescription Payment Plan

Educational Objectives for Pharmacists and Pharmacy Technicians:

1. Describe the benefits and features of the Medicare Prescription Payment Plan

2. Outline the responsibilities of Part D Sponsors and dispensing pharmacies under the Medicare Prescription Payment Plan

3. Discuss the characteristics of beneficiaries most likely to benefit from participating in the Medicare Prescription Payment Plan

4. Explain the resources available for Medicare Beneficiaries to learn more about the Medicare Prescription Payment Plan.

1. What can you tell patients who ask about the Medicare Prescription Payment Plan?

a. It will lower prescription drug costs for millions of Americans

b. It creates an option to pay for Part D prescriptions through a monthly invoice

c. The government will make this program available on January 1, 2026

2. What can members who participate in the Medicare Prescription Payment Plan expect?

a. They will pay $0 at the pharmacy for their Part D prescriptions

b. They must meet strict minimum income requirements

c. They will receive monthly invoices from their pharmacy

3. Which of the following is an M3P responsibility for dispensing pharmacies?

a. Provide counseling about the program

b. Distribute materials in response to claims messaging

c. Identify patients who are likely to benefit from the program

4. If a member fails to pay M3P invoices, what could happen?

a. They could be required to change pharmacies

b. They could be denied prescription drug coverage

c. They could be removed from the M3P program

5. Which of the following is a Medicare Part D Plan responsibility?

a. Processing M3P participation requests

b. Allowing a 90-day grace period for failure to pay M3P invoices

c. Developing guidance and member-facing documents

6. Which Medicare beneficiaries are most likely to benefit financially from using the M3P?

a. People who have high drug costs early in the year

b. People who have low drug costs throughout the year

c. People who have high drug costs late in the year

7. What advice can you offer to patients who do not benefit financially from the M3P?

a. They are not permitted to use the program

b. They must remain in the program until the end of the plan year

c. They may choose to join the program for non-financial reasons

8. Which of the following may patients consider a disadvantage to using the M3P, even for patients who may benefit financially from the program?

a. Invoice amounts that are not the same every month

b. Being required to change pharmacies to participate

c. Risk of losing their prescription coverage if they cannot pay their M3P invoices

9. Where can beneficiaries learn more about the M3P?

a. The 2024 “Medicare and You” Handbook

b. From their Plan Formulary

c. CMS and Plan websites

10. When will Medicare Part D Plans have M3P details available on their websites and start accepting M3P member elections?

a. After patients meet their annual deductible

b. No later than October 15, 2024

c. After January 1, 2025

References

Full List of References

References

Centers for Medicare & Medicaid Services. The Inflation Reduction Act Lowers Health Care Costs for Millions of Americans. Accessed April 27, 2024. https://www.cms.gov/priorities/legislation/inflation-reduction-act-and-medicare/lowers-health-care-costs-millions-americans

Centers for Medicare & Medicaid Services. Fact Sheet: Medicare Prescription Payment Plan. Accessed April 27, 2024. https://www.cms.gov/files/document/medicare-prescription-payment-plan-fact-sheet.pdf

Kaiser Family Foundation. Explaining the Prescription Drug Provisions in the Inflation Reduction Act. Accessed July 1, 2024. https://www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-inflation-reduction-act/

Centers for Medicare & Medicaid Services. Medicare Prescription Payment Plan: Final Part One Guidance on Select Topics, Implementation of Section 1860D-2 of the Social Security Act for 2025, and Response to Relevant Comments. Accessed April 27, 2024. https://www.cms.gov/files/document/medicare-prescription-payment-plan-final-part-one-guidance.pdf

Centers for Medicare & Medicaid Services. Medicare Prescription Payment Plan: Final Part Two Guidance on Select Topics, Implementation of Section 1860D-2 of the Social Security Act for 2025, and Solicitation of Comments. Accessed July 17, 2024. https://www.cms.gov/files/document/medicare-prescription-payment-plan-final-part-two-guidance.pdf

Centers for Medicare & Medicaid Services. What Happens When a Plan Member Doesn’t Pay Their Medicare Plan Premiums? Accessed April 28, 2024. https://www.cms.gov/outreach-and-education/outreach/partnerships/downloads/11338-p.pdf